nys workers comp taxes

Enter your telephone number in boxes below your signature. If you withhold less than 700 during a calendar quarter pay the tax with your Form NYS-45.

6 Things You Need To Know As An Employee Workers Compensation Insurance How To Stay Healthy Business Problems

However retirement plan benefits are taxable if either of these apply.

. You are responsible to pay the amount you withhold to the Tax Department as follows. Partners and LLC must be included at a minimum of 35100 and a maximum of 106600. If SSA lowers your monthly SSI benefit by 300 because of the workers compensation offset 300 of your workers comp becomes taxable.

Ad Looking to file your state tax return. See Need help. Liability and Determination Fraud Unit.

Workers Compensation Board Workers Compensation Law 158 25-a 151 214 and 228. You retire due to your occupational sickness. The quick answer is that generally workers compensation benefits are not taxable.

You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational injury or sickness. Make remittance payable to NYS Employment Contributions and Taxes. Do You Have to Pay Taxes on Workers Comp Benefits.

Explore state tax forms and filing options with TaxAct. New York State Department of Labor. Your maximum refund guaranteed.

While a worker does need to report these benefits on New York tax form W-2 Wage and Tax Statements the amount awarded by the New York State Workers Compensation Board is excluded from the gross pay for a work-related injury. TaxAct can help file your state return with ease. 63 rows NY Rates are currently about 155 higher than the national median.

NYSIF is a self-supporting insurance carrier that competes with private insurers in both the workers compensation and disability benefits markets in New York State. The New York State Workers Compensation Law does not require sole proprietors partners or officers of one or two-person corporations to provide coverage for themselves. A business that fails to maintain workers compensation insurance can be penalized 2000 per 10-day period of noncompliance.

In most cases they wont pay taxes on workers comp benefits. Learn about employer coverage requirements for workers compensation disability and Paid Family Leave as well as your rights and responsibilities in the claim process. You may also contact the Task Force weekdays at 518 485-2144 between 8 am and 4 pm or send us an e-mail.

Employees in the Company NYS who have a Workers Compensation Board Award for a prior tax year and the Award is Credited to NYS. Typically in New York workers that receive benefits from workers compensation due to an on the job injury are not subjected to taxes at the federal state or local levels. Building 12 - Room 282.

Overview When the Workers Compensation Board issues an award of compensation for a prior year disability period and any portion of the award is credited to NYS the State Insurance Fund sends a C8EMP Info form to OSC. Get Your Max Refund Today. It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury tendinitis or carpal tunnel.

The situation is more complex when a business that is exempt from coverage requirements either engages subcontractors or is a subcontractor that is engaged by a general. This is in addition to any actual award stemming from a workplace injury or sickness both compensation and medical costs which can result in six-figure liabilities. NYS EMPLOYMENT CONTRIBUTIONS AND TAXES PO BOX 4119 BINGHAMTON NY 13902-4119 Withholding identification number 24.

Over 13M Americans Filed 100 Free With TurboTax Last Year. One of the silver linings of a workplace injury is state and federal taxes dont apply so theres no wincing as you look at your pay stub and see where Uncle Sam took 20 or 30 off the top. The IRS manual reads.

Insurers authorized to transact workers compensation and employers liability insurance are subject to assessments by the Workers Compensation Board for the administrative costs of the Board Special Disability Fund Fund for Reopened Cases and. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Copy A along with Form W-3 goes to the Social Security Administration.

If you withhold New York State New York City or Yonkers income tax from your employees wages you must report it quarterly on Form NYS-45. Or you can complete the Tip Sheet. IRS Publication 525 Amounts you receive as workers compensation for an occupational sickness or injury are fully exempt from tax if theyre paid under a workers compensation act or a statute in the nature of a workers compensation act Return to work.

The following payments are not taxable. If you pay your nanny cash wages of 1000 or more in a calendar quarter or 2400 in a calendar year file Schedule H. Generally the Internal Revenue Service IRS does not consider NY workers compensation benefits to be taxable income.

The IRS in Publication 907 specifically states that workers compensation benefits for job-related sicknesses or injuries are not taxable. The New York State Insurance Fund NYSIF was established in 1914 as part of the original enactment of the New York Workers Compensation Law. Do you claim workers comp on taxes the answer is no.

Harriman State Office Campus. Fill out Form W-2 if you pay wages of 1000 or more and give Copies B C and 2 to your nanny. If you have more than one job at the same time with combined wages of more than 120 per week you may request each of your employers to adjust your contributions in proportion to the earnings of each employment.

This tax exempt status applies if the worker receives these benefits under a workers compensation act or law. NYS-45 119 back Mail to. Workers compensation benefits for work injuries are tax-exempt if they are paid under the workers compensation act and also includes the survivors that receive benefits for fatal injuries.

Workers Comp Exemptions in New York Sole-Proprietors included on workers compensation coverage must use a minimum payroll amount of 37700 and a maximum payroll amount of 114400 for rating their overall workers compensation cost. On Form NYS-45-I if you need forms or assistance. Individuals do not have to pay income taxes on workers compensation benefits according to IRS Publication 907.

Your contribution is calculated at the rate of one half of one percent of your wages but no more than 60 cents a week WCL 209. The amount of workers comp that becomes taxable is the amount by which the Social Security Administration SSA reduces your disability payments.

2020 Minimum Wage Increases Affordable Bookkeeping Payroll Minimum Wage Wage Payroll

Luis Rojas Named New Manager Of The New York Mets Small Business Insurance Commercial Insurance Business Insurance

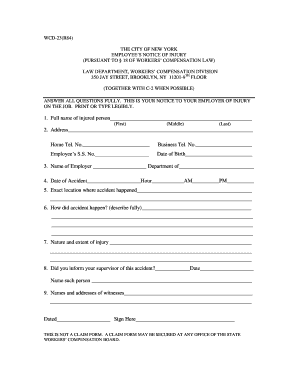

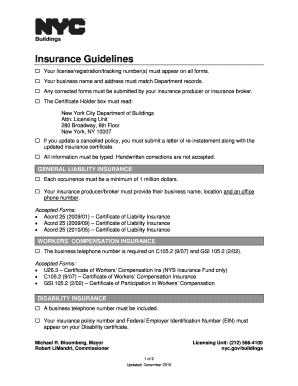

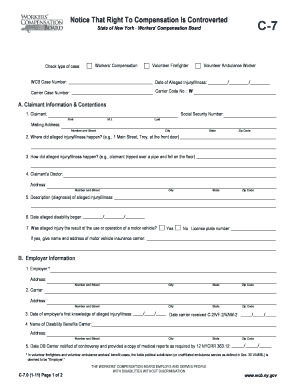

16 Printable Nys Workers Compensation Forms C 2 Templates Fillable Samples In Pdf Word To Download Pdffiller

Get Compensation For Your Construction Accident Injury In New York Workplace Safety Workplace Safety Tips Labor Law

Calculation Of Income Execution Payment Income Payment Execution

Can I Register A Car Thats Being Finance In New York Under Florida Insurance

16 Printable Nys Workers Compensation Forms C 2 Templates Fillable Samples In Pdf Word To Download Pdffiller

New York Workers Compensation How It Works

Visit New York State Of Health To Select The Right Health Insurance For Your Individual Family Or Sma Visit New York Health Insurance Health Insurance Options

16 Printable Nys Workers Compensation Forms C 2 Templates Fillable Samples In Pdf Word To Download Pdffiller

Some Interesting Finds From R Historyporn Old Photos Statue Of Liberty New York Architecture

16 Printable Nys Workers Compensation Forms C 2 Templates Fillable Samples In Pdf Word To Download Pdffiller

It Is Always Better To Be Ready With The Checklist As The Fiscal Year Nears Its End An Intelligent Businessperson Business Person Financial Year End Financial

Pin On Jesse D Burns Construction

Is Workers Comp Taxable Workers Comp Taxes

16 Printable Nys Workers Compensation Forms C 2 Templates Fillable Samples In Pdf Word To Download Pdffiller

Vdf 1 Form Fill Online Printable Fillable Blank Pdffiller

Section 32 Settlement Syracuse Ny Workers Compensation Lawyers Mcv Law